Property Taxes and Charges

This section provides information for property owners on annual property tax bill charges.

Under the Real Property Tax Act and Real Property Tax Act Regulations the Province provides a centralized collection system for property taxation. Annual property taxes and charges may include provincial property tax, municipal property tax, fire district charges and Island Waste Management (IWMC) charges.

The provincial real property tax rate for commercial and non-commercial property in the province is set at $1.50 for each $100 taxable value assessment. Under the Provincial Tax Credit Program, residents of PEI may be eligible for a provincial tax credit of $0.50 per $100 of taxable value assessment on any non-commercial property that they own. Each municipality and each fire district sets their own property tax rate in March of each year. IWMC sets the rates for garbage collection in the province.

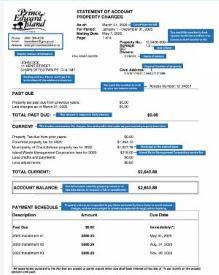

It is important for you, as a property owner, to better understand the information shown on your tax bill. This pdf tax bill explains the important categories and the sections on this web page provide further information and links.

Important Dates

You will be sent a Statement of Account – Property Charges from Taxation and Property Records in early May of each year. This statement will show the current year taxes and fees and any arrears balance. The statement also provides installment amounts, dates and payment stubs.

Installment dates for payment of property charges are May 31, August 31, and November 30 each year.

Where can I look up my account balance?

You can obtain information about your property tax account in several ways:

- Find current details about your property tax on the Property Tax Balance Inquiry page, including yearly installment amounts and amounts past due.

- Email your query to taxandland@gov.pe.ca. If you haven't already sent one in, please include a signed copy of the Authorization to Communicate by Fax and E-mail form.

- Call Taxation and Property Records at (902) 368-4070. You will be asked to provide the details of your last payment on your property tax account to verify your identity.

How do I change my mailing address?

Under subsection 12(3) of the Real Property Tax Act, the property owner must inform Taxation and Property Records in writing of a change of address. You can fill out a Request for Change of Assessed Owner’s Name or Address (503 Kb) (Formulaire de changement de nom ou d’adresse du propriétaire désigné ou de la propriétaire désignée (518 Kb) and submit as directed on the form to Taxation and Property Records to notify Taxation and Property Records of a change of address.

If you are a property owner and you do not receive a property tax bill in May of each year, please refer to Owner Name and Mailing Address used for Property Tax Bills or contact Taxation and Property Records at (902) 368-4070.

It is the property owner's responsibility to ensure that Taxation and Property Records has the correct mailing address on file. Failure to receive a property tax bill does not relieve a property owner of their responsibility to pay property charges on time.

How can I make payments?

You can make property charge payments using any of the following methods:

- Pay on-line using internet banking bill payment services offered by your bank or credit union

- Pay by cheque, cash or debit at a bank or credit union

- Pay by cheque, cash or debit at any Access PEI location

- Send a cheque by mail addressed to: Province of Prince Edward Island, Department of Finance, PO Box 880, Charlottetown, PE C1A 7M2

- Drop off a cheque at the payment drop box or at the Taxation and Property Records front counter located at 95 Rochford Street, 1st Floor Shaw South, Charlottetown

Cheques are to be made out to Minister of Finance.

NOTE: Payments will not be accepted by Interac e-Transfer or any other means of sending payment to an e-mail address. If you have sent payment by Interac e-Transfer or by e-mail, please cancel the payment as we cannot guarantee it can be cancelled from the e-mail address to which it may have been sent.

What happens if I do not pay my property charges on time?

Property tax accounts in arrears will be charged one percent (1%) interest per month calculated on a daily basis.

If property taxes and charges are in arrears for 15 months or longer the property owner will receive a Notice of Liability to Tax Sale. Information on the Notice of Liability to Tax Sale and its impact on the property owner can be found in the Property Tax Bulletin - Notice of Liability to Tax Sale Bulletin.

Can I get a refund of property taxes if I have a credit balance on my account?

If there is a credit on your Statement of Account – Property Charges you can:

- Use the credit towards the next year’s property charges; or

- Request a property tax refund by completing the Request for Property Tax Refund form and submitting it to Taxation and Property Records as directed on the form.

What is my municipal property tax rate?

For detail on municipal property tax rates across the province, please refer to View Municipal Tax Rates and Fire District Charges.

What are my fire district charges?

For detail on fire district charges across the province, please refer to View Municipal Tax Rates and Fire District Charges.

What are the Waste Watch charges?

For detailed information on waste watch rates and services, please refer to the IWMC website.

Disclaimer: This page is prepared for information purposes only, and should not be considered a substitute for the applicable statutes. Should there be any conflict between the contents of this page and the statutes, the statutes shall prevail.